One misstep with customs could lead to a disaster. What can you do to avoid this?

Cross-border shipping is a lot like baking. You’ve got to have the right tools, follow instructions, and do things in the correct order.Plus there’s a lot of questions you have to ask: what are customs, what paperwork is required, what is DDP shipping?

One error could lead to a big disaster.

If you’re unsure what a baking mishap looks like, you need to check out the Netflix series Nailed It!

In each episode, a group of three amateur bakers competes to recreate intricately decorated desserts. If you’ve ever tried to make a picture-perfect dessert from a Pinterest recipe, you know it’s rarely as easy as it looks.

Unfortunately for many stores, cross-border shipping is the eCommerce equivalent of a Pinterest fail.

In theory, it seems simple.

You already ship teacups, necklaces or sweater from one state to another. How much more different could it be to ship to another country?

- You get your first order from the U.K.

- Do a quick internet search

- Send your first order from Nashville to London

It’s that easy right? Well, you could have your customer’s order held up in customs for two weeks or more. Yikes.

What should you have done instead?

Today we’re helping you cook up a recipe to avoid a customs calamity.

We’ll examine what customs is, why it’s a hassle, and what you can do to prevent some of the most common problems.

How does customs work for packages?

When items ship from one country to another, they have to go through customs before they can be released for final delivery.

Does customs check every package?

The short answer is yes. Customs checks all inbound international packages and mail. During this process, a customs officer in the country you’re shipping to will review the package to make sure it meets the country’s laws, regulations and policies. They will also determine what duties and taxes might be due.

If you’ve traveled internationally, you went through customs when you landed. You probably filled out a form beforehand with questions ranging from basic to somewhat odd, like if you’re transporting soil or animal parts. Then you answered a few of the customs officers’ questions once you got off the plane. And before you know it, you’re on your way.

Customs for packages works similarly. You still must have a customs form. The main difference is you’re not with the package to answer any questions the customs officer has. And that’s where the problem lies for many novice cross-border shippers.

Quick clearance requires providing all the right information about your package before you ship it.

Do customs open every package to verify information?

No, customs officers will not open up your package or packages without good reason. Every package is put through a scanner machine, or an x-ray machine, to verify that the items you are shipping match your customs forms. They will, however, instantly open up a package if it is damaged, has irregularities (a.k.a. is not consistent with your declaration form), or if you are a part of a random checking.

How long do packages stay in customs on average?

Unfortunately, there’s no cut and dry answer for how long packages stay in customs. This varies greatly from country to country, and largely depends on what is being shipped. Packages can get approved immediately, which is often the case if the goods being sent aren’t taxable. Other times, delays can occur if duties and taxes are still owed It’s also common for items to get stuck in customs if an item is restricted and cannot be allowed into the country.

Why is customs such a hassle for ecommerce shippers?

Customs can be quite a headache for new cross-border shippers. Last year, World Customs Organization (WCO) Secretary General Kunio Mikuriya said customs officers around the globe were struggling with a “tsunami of small packages” thanks to the growth of eCommerce.

Most customs systems were designed to handle bulk orders from wholesale importers. If you regularly ship three pallets of paper plates, you probably know what you’re doing and have your paperwork in order.

However, the rise of B2C eCommerce drastically changed the volume of packages moving through customs. At the same time, many countries are introducing new regulations to capitalize on the growing eCommerce market or in some cases to protect domestic industries from growing international eCommerce rivals.

Cross-border eCommerce is growing at twice the rate of domestic eCommerce and is expected to represent nearly one-fourth of global online sales by next year, according to recent estimates.

The increase in cross-border shipping is driven by sellers and buyers who may lack extensive experience with customs.

So not only are customs officers dealing with a massive increase in the number of packages they’re processing – many of the packages are missing the vital documentation customs officers need to do their job and move the package along the process.

What causes a package to get stuck in customs?

So what can you do to make sure your package isn’t stuck in customs? The first step is understanding what customs officers are looking for and what can cause them to hold your package.

The most frequent reasons a package gets stuck in customs are:

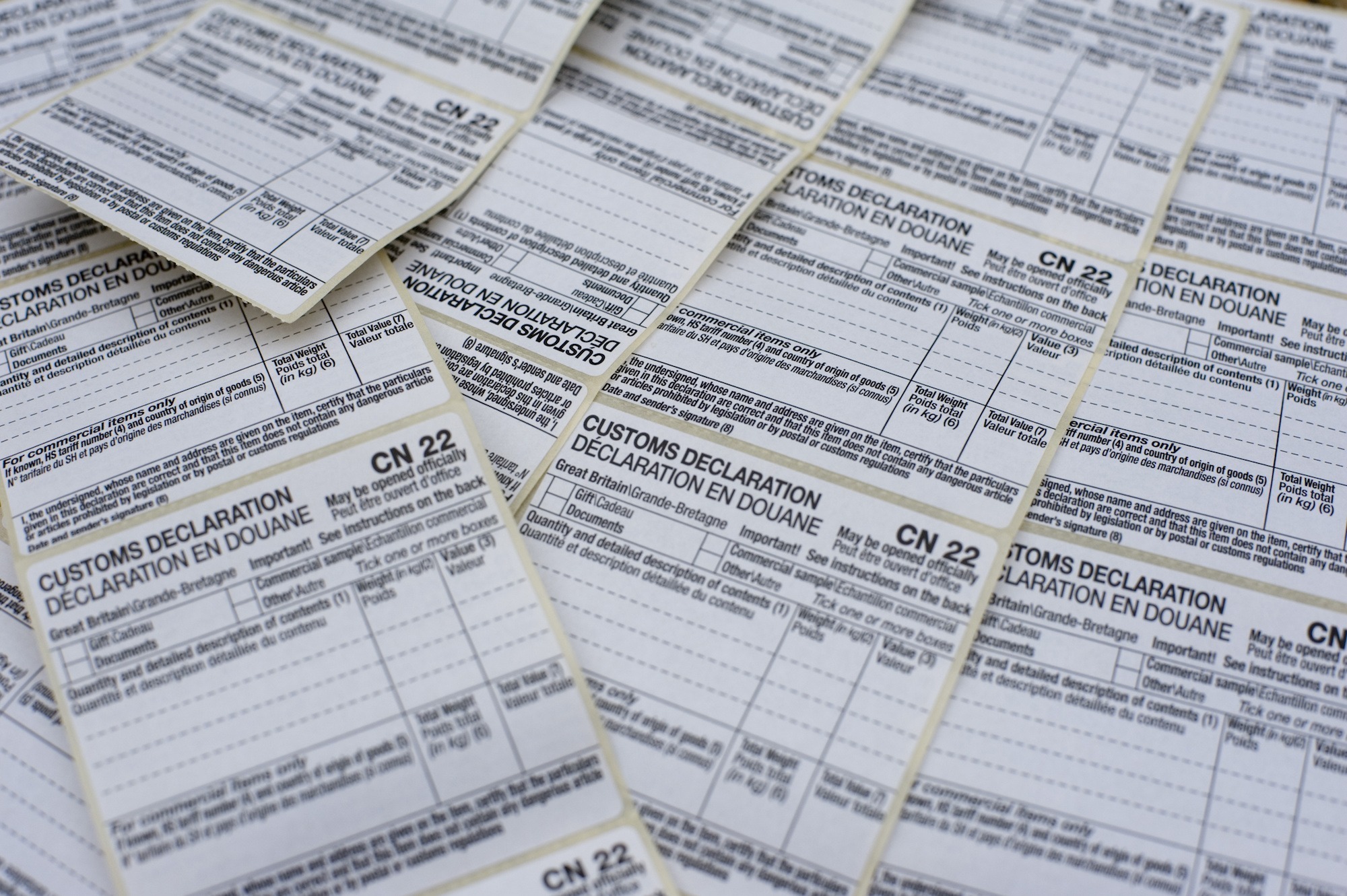

Missing Paperwork

Every international package will need a commercial invoice and a customs declaration form. The customs officer will use these forms to determine the value of the goods and what duties and taxes may be due. The commercial invoice should include details about the seller and the buyer, as well as more information about each item in the order:

- Unit Price

- Total Price

- Shipping cost charged to the customer

- Total Commercial Value

- Country of origin

- Item description and code from the Harmonized Commodity Description and Coding Systems

Note: Item codes can be tricky for new cross-border sellers. We recommend reaching out to your shipping carrier for help in making sure your inventory has the right HS code.

Having the correct paperwork isn’t just about making the customs officer’s job easier. Incorrect or missing paperwork could result in an officer tearing open your package to inspect it or possible fines or criminal penalties.

Unpaid Duties or Taxes

Nothing is leaving customs if the appropriate duties and taxes aren’t paid. When shipping internationally, you have two choices. You can ship with the duties and taxes already paid (DDP) or unpaid, where the buyer has to pay them upon delivery (DDU).

For more on DDP vs DDU check out our blog explaining both. If you’re shipping DDP and made a mistake in calculating the amount due, the balance will need to be paid before the package is released for final delivery. In this case, somecarriers may bill you for the difference plus an additional fee for their efforts.

Shipping Prohibited Items

A customs officer’s job is to do more than making sure you pay taxes. Customs officers also make sure prohibited items aren’t being shipped into the country.

When shipping to a new country, it’s essential to learn about any specific regulations they have.

Here are a few examples from some of the top growing eCommerce markets:

- China restricts imitation firearms and some types of communications devices and cosmetics.

- The United Kingdom typically bans firearms and other weapons and has restrictions on meat and dairy from outside the European Union.

- Germany, like the UK, also has restrictions on food products from non-EU member countries and additional limits on some medical and dental supplies.

- France imposes restrictions on electronics, alcoholic beverages and food from outside the EU. Additionally, France requires French language on all packaging.

- Canada places restrictions on pharmaceuticals, agricultural, food items, and some pet foods.

This isn’t an extensive list, but hopefully gives you an idea of what types of restrictions could exist in a country you’re considering shipping to. For more detailed information, be sure to check out Export.gov. You should also consider configuring your eCommerce platform so that customers shipping to a country where an item is prohibited cannot purchase that item.

What About Brexit?

As of December 31, 2020, the United Kingdom has officially withdrawn from the European Union. Following this withdrawal, theEU–UK Trade and Cooperation Agreementwas proposedand currently allows for free trade of most goods with no tariffs or quotas. However, companies are still required to comply with customs regulations. They must pay customs fees and VAT (value-added tax), plus provide rules of origin paperwork to prove goods have been locally sourced.

Get more information about Brexit shipping changes

Conclusion

We hope you’re feeling confident enough to begin cross-border shipping. Remember to Nail it and not end up with a shipping fail, follow this simple recipe:

- Check the country-specific regulations for your product at export.gov

- Make sure your paperwork is in order, including information like harmonization codes

- Leverage a partner to take care of the heavy lifting of clearing customs

Building out your global shipping strategy?

Try a 15-day free trial of ShipperHQ

Start my free trial

I bring to you my expertise in international shipping and customs procedures, having actively worked in the logistics and cross-border eCommerce industry for several years. My insights are not merely academic but are grounded in practical experiences dealing with the intricacies of customs regulations, shipping documentation, and the challenges faced by businesses in the global marketplace.

Let's delve into the concepts mentioned in the article and provide detailed information:

-

Customs Process for Packages:

- When items are shipped internationally, they must go through customs before being released for final delivery.

- Customs officers in the destination country review the package to ensure it complies with local laws, regulations, and policies.

- Customs officers determine applicable duties and taxes during this process.

-

Customs Clearance and Package Verification:

- Customs officers do not open every package without reason. Instead, packages go through scanners or x-ray machines to verify the declared information.

- Customs officers may open a package if it is damaged, has irregularities, or is part of a random check.

-

Duration of Customs Clearance:

- The time packages spend in customs varies by country and depends on the nature of the items being shipped.

- Approval can be immediate for non-taxable goods, while delays may occur if duties and taxes are owed or if an item is restricted.

-

Challenges in Customs for eCommerce Shippers:

- The increase in cross-border eCommerce has overwhelmed customs systems designed for bulk orders, leading to a "tsunami of small packages."

- New regulations are being introduced globally to address the surge in cross-border shipments.

-

Common Reasons for Packages Getting Stuck in Customs:

-

Missing Paperwork:

- Every international package requires a commercial invoice and a customs declaration form.

- Incorrect or missing paperwork can result in delays, package inspection, fines, or penalties.

-

Unpaid Duties or Taxes:

- Duties and taxes must be paid for the package to leave customs.

- Shipping options include DDP (Duties Paid) or DDU (Duties Unpaid), each with its implications.

-

Shipping Prohibited Items:

- Customs officers ensure prohibited items are not shipped into a country.

- Sellers should be aware of specific regulations in the target country to avoid shipping restricted items.

-

-

Country-Specific Regulations and Examples:

- Different countries have specific regulations and restrictions on items, e.g., China restricts imitation firearms, the UK bans firearms, Germany has restrictions on food products, and so on.

- Sellers should research and comply with the regulations of the destination country.

-

Brexit Considerations:

- Post-Brexit, the EU–UK Trade and Cooperation Agreement allows for free trade of most goods but requires compliance with customs regulations.

- Companies must pay customs fees, VAT, and provide rules of origin paperwork.

-

Conclusion and Shipping Strategy Tips:

- Businesses should check country-specific regulations, ensure proper paperwork with harmonization codes, and leverage partners for customs clearance.

- Consider a trial of services like ShipperHQ for building a robust global shipping strategy.

In conclusion, successful cross-border shipping requires meticulous planning, adherence to regulations, and proactive measures to avoid common pitfalls in the customs process.