If you’re reading this article, you're probably aware of VAT refunds, or have even experienced the joy of shopping tax-free in France before.

But did you know that the way you validate your refund form can differ quite a lot depending on where you’re flying or training home from?

In this article, we’ll give you a complete guide on how to claim your VAT back when you leave the EU from Paris, so no matter where you’re leaving from, you’ll get your VAT refund with no problem.

A recap on tax refunds

There are two main steps to getting a VAT refund on shopping:

Get a refund form

Validate your refund form

Getting a refund form

There are two main ways you can get a tax refund form – using the traditional, in-store paper method, or a digital app like Wevat.

Using the traditional method, you’ll need to show your passport to the sales assistant, ask for a refund form, and do some form filling every time you buy something.

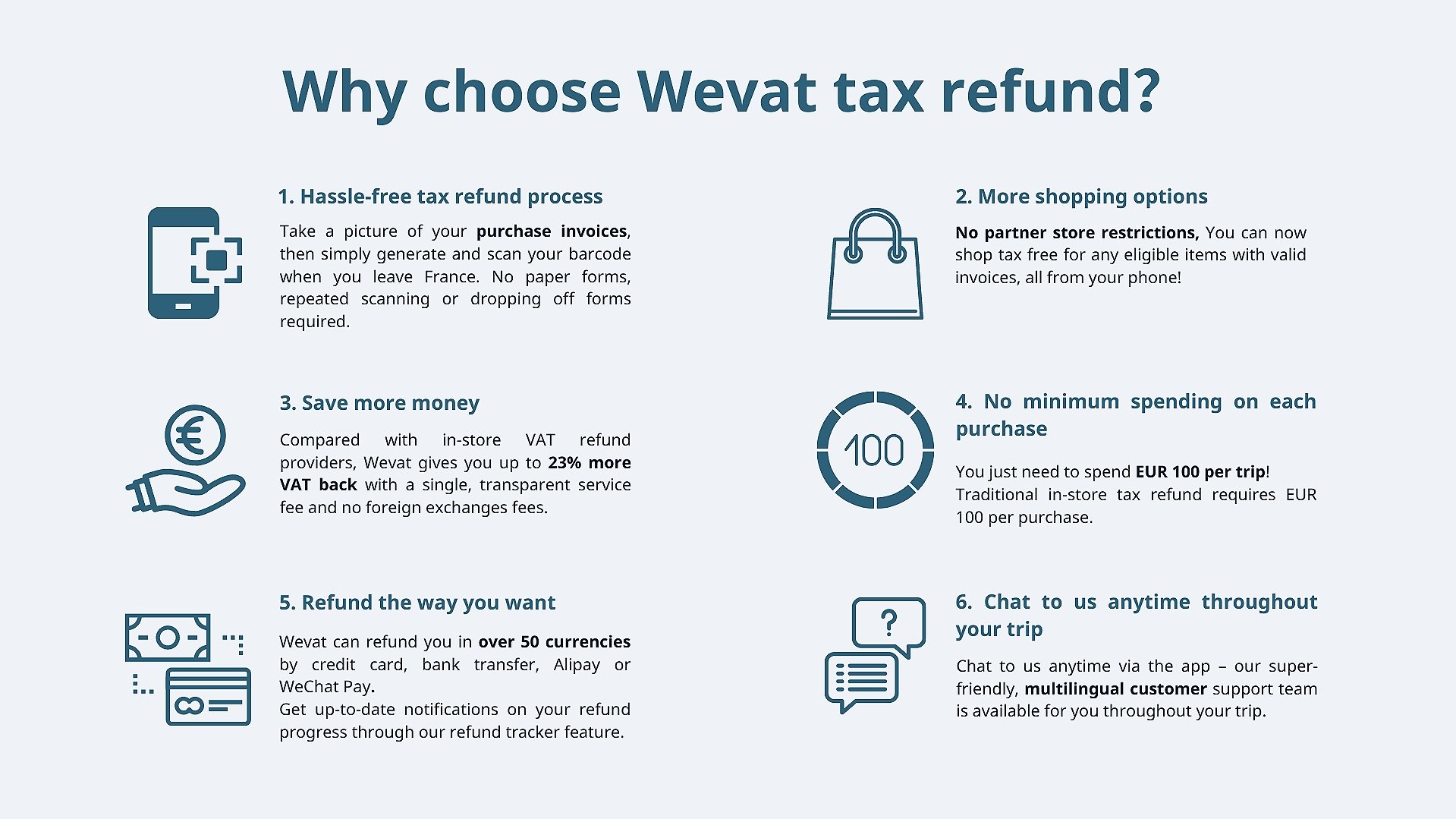

With a digital app like Wevat, you don’t need to do any of that – our app combines invoices together into a single digital refund form, accessible at any time on your phone.

Another perk of using an app is that you get more money back compared with the in-store method, and can track your refund in real-time, so you never have to worry about losing your refund.

You’ll also find that many shops, especially high-street boutiques and small shops, are not set up to offer a VAT refund to tourists. This is where Wevat comes in handy – the app works even for purchases made at shops not set up to issue a refund form. Instead of asking for a refund form, you only need to ask for an invoice (”facture”) instead. Check out our comparison of digital vs. traditional in-store tax refunds for more information.

Another huge advantage is that there is no minimum spend per purchase. Traditionally, you had to spend €100 per transaction to qualify for a VAT refund, but with Wevat, you’re eligible as long as you spend a total of over €100 across all your purchases.

You may end up with a combination of paper and digital forms depending on the stores you use, and that is totally fine. Where you can, you might want to use the Wevat app to process your ‘factures’ into a digital refund form, which will save you time and money overall.

Validating your refund form

Whichever method you choose, you will need to validate your refund form at your final departure point before leaving the EU.

At many Parisian departure points – such as the Gare du Nord Eurostar train station or the Charles de Gaulle (CDG) airport – you can now make use of electronic “détaxe” kiosks (referred to as “PABLO” kiosks) to easily scan and validate your forms in a matter of minutes. Where this is not available, you will need to find the local customs office by following the “détaxe” signs at the departure point and have a printed, paper version of your refund form physically stamped in order for it to be validated.

Wevat saves you the hassle and faff of needing to keep (and not lose!) your paper refund forms, instead aggregating all your purchases into a single barcode that can be accessed at any time on your phone.

Ever get butterflies in your stomach as you approach the airport? Or maybe you’re just too busy running flat out to your gate... Whichever type of traveller you are, we’ve been there too. So to save us all from the stress of confusion of validating a refund form, we’ve summarised the key steps that work at any departure point in Paris.

Before heading to the departure point:

To avoid having your VAT refund claim rejected, do this well in advance of heading to your departure point.

If you’re using Wevat:

Upload your invoices onto the app 12 hours before your train or flight so they can be verified in time. We recommend adding your invoices as you shop. If you are shopping last minute, that’s also fine – just let us know using in-app chat so we can accelerate the verification for you

6 hours before your flight, generate your refund form in-app and check all the information is correct

If you’re using the traditional in-store method:

Make sure you’ve asked for a refund form at every shop you made a purchase at. The receipt itself does not qualify for a tax refund!

Have all the receipts of your purchased goods and tax refund paper forms issued from shops prepared

What to do at the departure point?

Arrive at your departure point 3 hours before your departure time

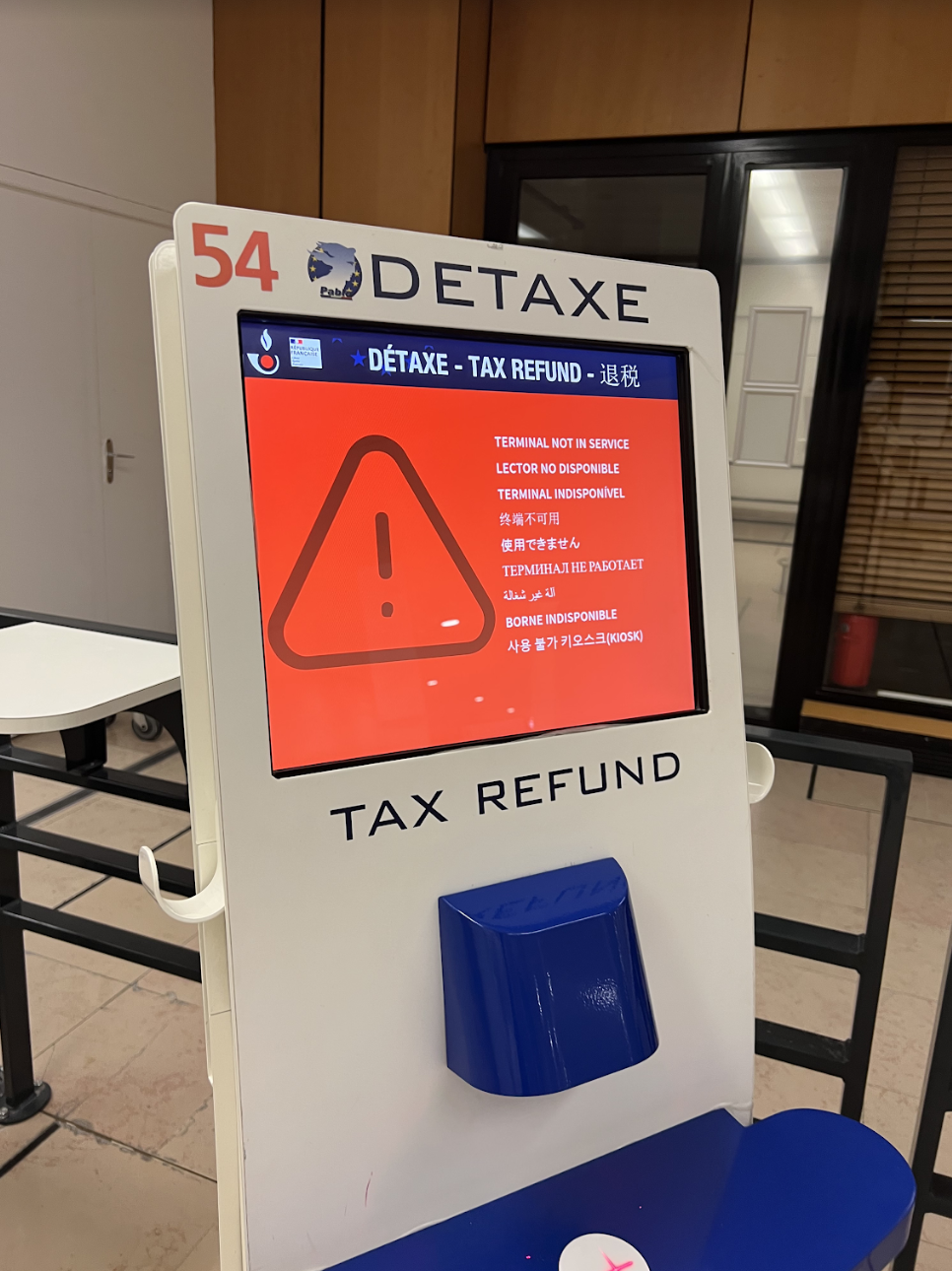

Before checking in your luggage, follow the “Détaxe” signs and go validate your refund form first thing. This prevents delays due to queues, machines that are out of order, or sporadic but unforeseen circ*mstances that can prevent you from validating your form.

Note that the Gare de Nord Eurostar station is an exception – the PABLO détaxe kiosks are located after security in the waiting lounge.

Make sure the goods you shopped for are easily accessible and with you, as French Customs may ask to see these at the customs. We recommend sticking them in hand luggage so you don’t check them in by accident.

Where to do your tax refunds at Parisian departure points?

You’ve done all the hard bits, and time it’s time to bring the money home. So don’t forget this final but crucial step!

“Getting your tax refund done” is what people colloquially refer to when they get their refund form validated by customs. You have to do this before leaving the EU, as it becomes practically impossible to do this step once you’re back in your home country.

To do this, you’ll need to locate the customs “Détaxe” area (usually found before check-in – see Gare du Nord Eurostar for exception). Below’s a guide for all the major departure points in Paris.

1. Paris Charles de Gaulle (CDG) airport

We’ve written an extensive blog article on the major Parisian airport before. Check it out for maps and step-by-step instructions.

You will find these signposted as ‘Détaxe / Tax Refund’ located at:

Terminal 1: CDGVAL level, Hall 6

Terminal 2A: Departures level, Gate 5

Terminal 2C: Departures level, Gate 4

Terminal 2E: Departures level, Gates 3/4

Terminal 2F: Arrivals level,

Terminal 3: Departures level, international customs zone

2. Paris Gare du Nord Eurostar station

Given the popularity of tax-free shopping for British residents, we have also written a full blog post with step-by-step instructions. Make sure you read that if this is where you’re leaving from.

Once you arrive at the Gare du Nord Eurostar station, you’ll need to enter ticket gates first, go through customs and security checks, then you’ll see tax refund kiosks with obvious détaxe signs. If you can't find the kiosks, just ask the staff to direct you to the tax-refund kiosks.

During peak times there may be a long queue so make sure you arrive with lots of time so you can go through your tax-refund process when you get to customs.

Important note: these instructions only apply if you’re leaving Gare du Nord by Eurostar to go to London. If you are taking any other train (RER, SNCF), etc. that does not depart from the Eurostar terminal, you’re not able to get a tax refund at Gare du Nord and these instructions do not apply to you.

3. Paris Orly airport

Go to the French Customs tax refund desk (“Détaxe”) once arriving at your departure terminals before check-in for your flight. For Terminals 1&2 it is located at departure on the first floor (the best way to find it is by following the Détaxe sign or asking for staff at the airport).

4. Paris Beauvais airport

Paris Beauvais airport does not currently have a PABLO kiosk, but they are being installed soon, which means you’ll be able to make use of a fully digital validation procedure.

5. Gare du Lyon

If you are leaving from Gare De Lyon, there are no “Détaxe” PABLO kiosks available at the station. If you’re traveling from France to Switzerland, you may need to get off the train at the border and find the French customs office to get your refund form validated.

How to get your tax refund form approved?

Once you get to the self-service kiosks, just follow the self-explanatory on-screen instructions if you’re using Wevat:

Select your language

Scan the barcode on your digital form in the Wevat app

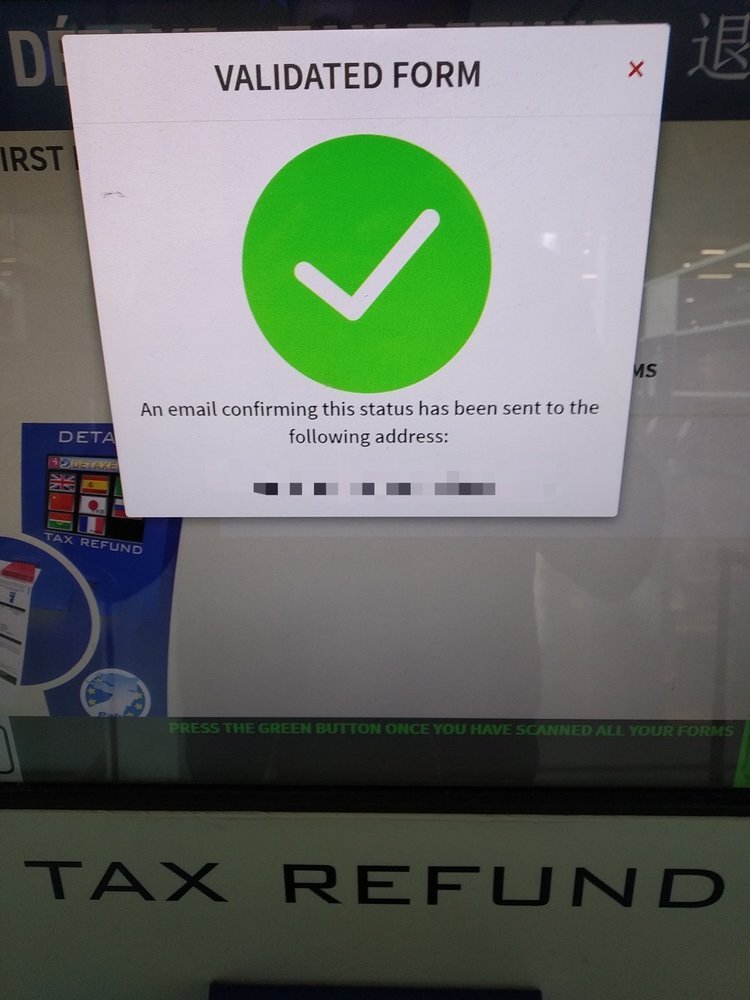

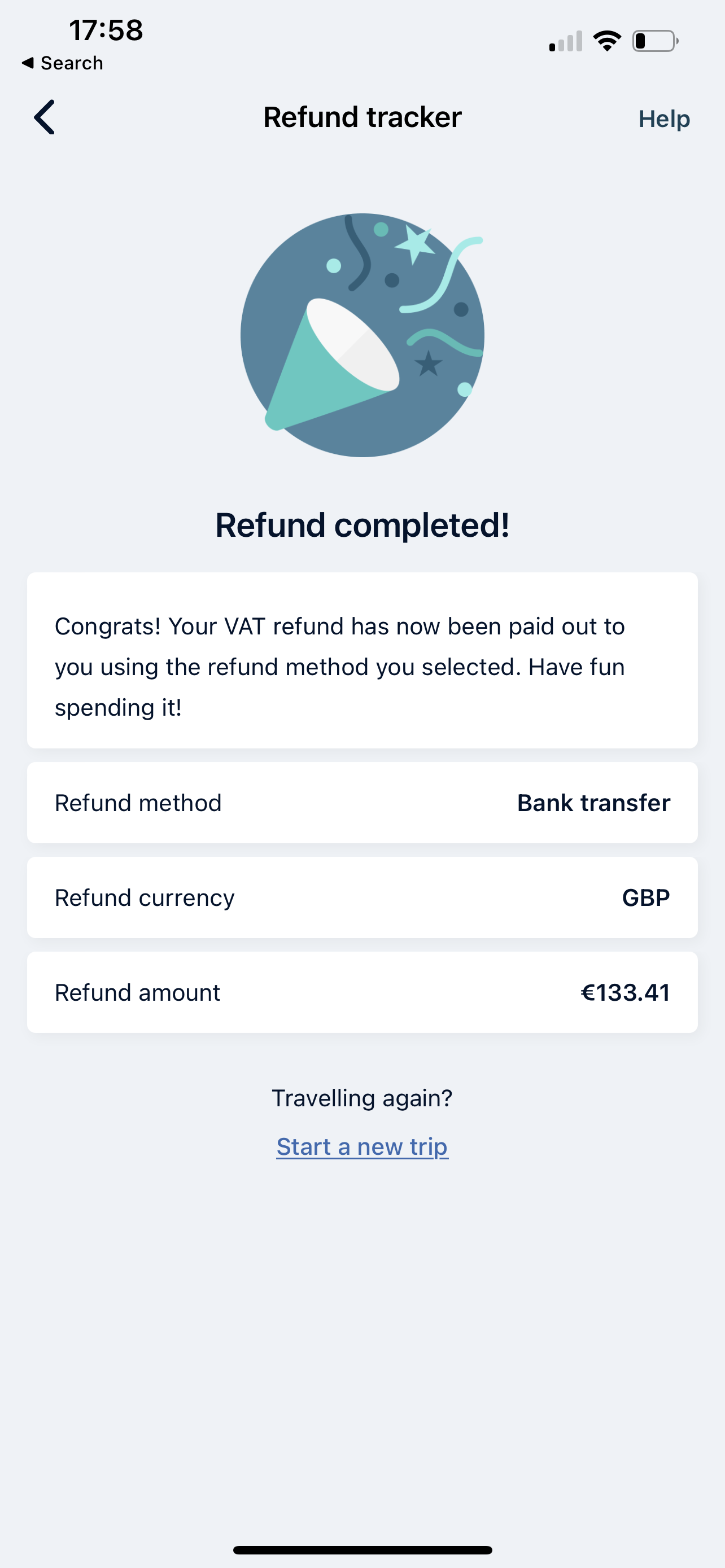

Wait for customs approval (a green screen will appear with the message "Validated Form"). We also recommend that you take a picture of the screen for your records. All that's left to do is wait to receive your refund via your preferred refund method. If you want to track your refund, just refer to the in-app tracker or contact the customer support team via live chat.

If you have any traditional paper tax refund forms, scan the barcodes one by one as above. These validated paper forms will then need to be mailed to the designated refund mailbox (most often located on the customs desk near the PABLO machine) with the original receipts. Then you will receive your refund back the method you chose when you issue the tax refund forms in the shop. You can email a traditional tax refund company if you want to check its status.

What if a red screen appears?

Don’t worry, this is normal.

Occasionally, French customs will want to manually check your passport and purchases, possibly even your invoices and receipts. If you see this screen, follow the instructions to go to the customs counter which is usually very close to the PABLO “détaxe” kiosks, and they will complete the process for you.

Success!

Once your form has been validated, you should receive your refund shortly. It's as simple as that!

Meanwhile, you can take your goods home to enjoy and use, and wait for some money to get transferred back into your account.

About Wevat

Wevat is a digital tax refund app that makes it easy for travellers to save money on their shopping in France! We are a community of people who love traveling, shopping, and saving money. Since our launch in 2019, we've helped refund travellers from 88 countries more than €18 million on their shopping.

Compared with in-store VAT refund providers, Wevat gives you up to 23% more VAT back with no minimum spending requirements on each purchase. With Wevat, you can simply snap a picture of your purchase invoices and then generate and scan your barcode when you leave France. There are no paper forms, repeated scanning, or dropping off forms required with us. Our super-friendly, multilingual customer support team will be always on hand to support you throughout your trip via our app.

We are fully regulated by both French and UK customs and tax authorities.

Download our app now to start saving money on your shopping in France!

You might be interested in:

Can I get VAT back at any shop when travelling to France as a tourist?

How to get a VAT refund at Galeries Lafayette in France?

Please download before purchase to validate shopping.

Tax-free Shopping Guide

Wevat

France, VAT refund in france, tax free shopping

Comment