What is the 50/30/20 wealth rule?

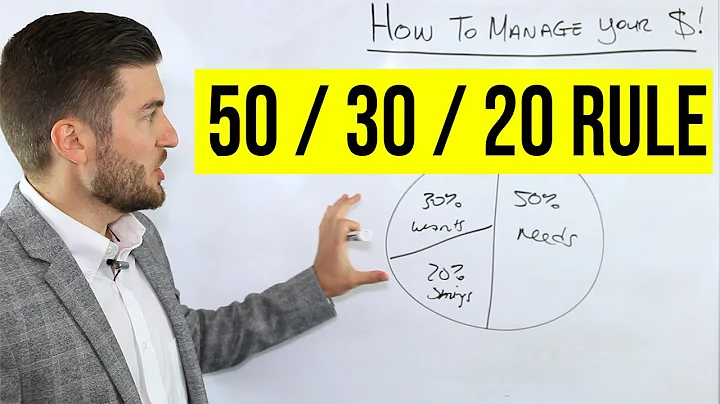

Those will become part of your budget. The 50-30-20 rule recommends putting 50% of your money toward needs, 30% toward wants, and 20% toward savings. The savings category also includes money you will need to realize your future goals. Let's take a closer look at each category.

The 50/30/20 rule can be a good budgeting method for some, but it may not work for your unique monthly expenses. Depending on your income and where you live, earmarking 50% of your income for your needs may not be enough.

The 50/30/20 rule is an easy budgeting method that can help you to manage your money effectively, simply and sustainably. The basic rule of thumb is to divide your monthly after-tax income into three spending categories: 50% for needs, 30% for wants and 20% for savings or paying off debt.

50% of your net income should go towards living expenses and essentials (Needs), 20% of your net income should go towards debt reduction and savings (Debt Reduction and Savings), and 30% of your net income should go towards discretionary spending (Wants).

Our 50/30/20 calculator divides your take-home income into suggested spending in three categories: 50% of net pay for needs, 30% for wants and 20% for savings and debt repayment. Find out how this budgeting approach applies to your money.

One popular guideline, the 50/30/20 budget, proposes spending 50% of your monthly take-home pay on necessities, 30% on wants and 20% on savings and debt repayment. The necessities bucket includes non-negotiable expenses like utility bills and the monthly minimum payment on any debt you have.

The 50-30-20 rule recommends putting 50% of your money toward needs, 30% toward wants, and 20% toward savings. The savings category also includes money you will need to realize your future goals.

Getting by on $1,000 a month may not be easy, especially when inflation seems to make everything more expensive. But it is possible to live well even on a small amount of money. Surviving on $1,000 a month requires careful budgeting, prioritizing essential expenses, and finding ways to save money.

The formula is really simple: Monthly income minus monthly expenses = zero. If your monthly income is $5,000, you list $5,000 in expenses. If there is $200 left after listing expenses, find a place for it so your bottom line reads zero.

Alternatives to the 50/30/20 budget method

For example, like the 50/30/20 rule, the 70/20/10 rule also divides your after-tax income into three categories but differently: 70% for monthly spending (including necessities), 20% for savings and for 10% donations and debt repayment above the minimums.

Is $4000 a good savings?

Ready to talk to an expert? Are you approaching 30? How much money do you have saved? According to CNN Money, someone between the ages of 25 and 30, who makes around $40,000 a year, should have at least $4,000 saved.

By age 35, aim to save one to one-and-a-half times your current salary for retirement. By age 50, that goal is three-and-a-half to six times your salary. By age 60, your retirement savings goal may be six to 11-times your salary. Ranges increase with age to account for a wide variety of incomes and situations.

- 50% for mandatory expenses = $2,000 (0.50 X 4,000 = $2,000)

- 30% for wants and discretionary spending = $1,200 (0.30 X 4,000 = $1,200)

- 20% for savings and debt repayment = $800 (0.20 X 4,000 = $800)

Some Experts Say the 50/30/20 Is Not a Good Rule at All. “This budget is restrictive and does not take into consideration your values, lifestyle and money goals. For example, 50% for needs is not enough for those in high-cost-of-living areas.

In the golden rule, a budget deficit and an increase in public debt is allowed if and only if the public debt is used to finance public investment.

The 50/30/20 budget rule might not be realistic for those dealing with economic challenges——which, let's face it, is pretty common in today's climate of high inflation and living costs. “It's unrealistic for most people,” Musson says.

But when it comes to what they need to be saving, it depends. So, if we're starting with a 30-year-old, they should be probably saving close to $580, $600, at least, a month. And that's if they're going to earn a high rate of return. So it depends on how aggressive and risky that they're looking to be.

To reach $10,000 in one year, you'll need to save $833.33 each month. To break it down even further, you'll need to save $192.31 each week or $27.40 every day. These smaller chunks are much more realistic and simple to comprehend, making it easier to track your progress.

Making $4,000 a month based on your investments alone is not a small feat. For example, if you have an investment or combination of investments with a 9.5% yield, you would have to invest $500,000 or more potentially. This is a high amount, but could almost guarantee you a $4,000 monthly dividend income.

| Age range | Average balance | Median balance |

|---|---|---|

| 25-34 | $37,557 | $14,933 |

| 35-44 | $91,281 | $35,537 |

| 45-54 | $168,646 | $60,763 |

| 55-64 | $244,750 | $87,571 |

Is 50/30/20 based on gross or net?

Try the 50/30/20 budget

First, calculate your net income (again, this is your take-home pay, or your after-tax income). From there, set aside 50% of your take-home pay for rent, utilities, groceries, transportation, insurance, and other living essentials that typically cost the same month to month.

In addition, the 80-120 rule specifies that an organization's participant count must include: actively participating employees, retired, deceased, or separated employees who still have assets in the plan, and. all eligible employees who have either yet to enroll or have elected not to enter the plan.

Key Takeaways. The 50/30/20 budget rule states that you should spend up to 50% of your after-tax income on needs and obligations that you must have or must do. The remaining half should be split between savings and debt repayment (20%) and everything else that you might want (30%).

“Retiring on $2,000 per month is very possible,” said Gary Knode, president at Safe Harbor Financial. “In my practice, I've seen it work. The key is reducing expenses and eliminating any market risk that could impact your savings if there were a major market downturn.

Outside the most expensive parts of the United States, $5,000 per month is typically enough to cover rent or mortgage payments and other lifestyle expenses if you're mindful of your budget.